This is a research program funded by National Research Council of Thailand through Foundation of Thai Gerontology Research and Development Institute. The primary objective is to achieve better insight to actual demand for asset management of Thai elderly, in order to reinforce their welfare and prevent abusive activities against them. The program comprises two projects, which are "Alternative Asset Management System for Thai Elderly" and "Accessibility of Reverse Mortgage for Thai Elderly".

Alternative Asset Management System for Thai Elderly

Alternative_Asset_Management_System_for_Thai_Elderly_infographic.pdf

The objective of this research is to study actual asset management of Thai elders and their demand for alternative asset management mechanisms. The study is based on an integration of both quantitative and qualitative research methods. Quantitatively, the study employs a questionnaire to survey subjects from simple random sampling (SRS) within purposively selected networks of seniors in Bangkok and six provinces from all regions of Thailand, including Nakhon Si Thammarat, Nonthaburi, Phayao, Ratchaburi, Trat, and Ubon Ratchathani. The surveyed data are then analyzed with logistic regressions. The qualitative method used in the study is an in-depth interview.

The results showed that more than one-third of the subjects have demand for asset management, which is positively correlated with debt-service burden, expenditure, and a threshold level of asset possession, but negatively with subjective happiness. The demand for asset management and related problems is also found to vary across individuals’ profiles. Inadequate saving, which is the most commonly-observed problem, generally links to those with low income and assets, whereas problems related to utilization, maintenance, and transfer of assets are largely corresponding to civil servants and those with higher education. In addition, trust and privacy are important, as the elders predominantly manage assets by themselves or consult their immediate family members.

In term of management mechanisms, the three mostly wanted services are consulting services when having troubles, asset-management and financial consulting service, and reverse mortgage, all of which are preferred to be under government regulation. However, the elders do not see necessity of a specific law for asset management, implying that governmental policies to help reinforce existing market mechanisms to efficiently supply asset management services should be more appropriate than the government’s direct supply operations.

Accessibility of Reverse Mortgage for Thai Elderly

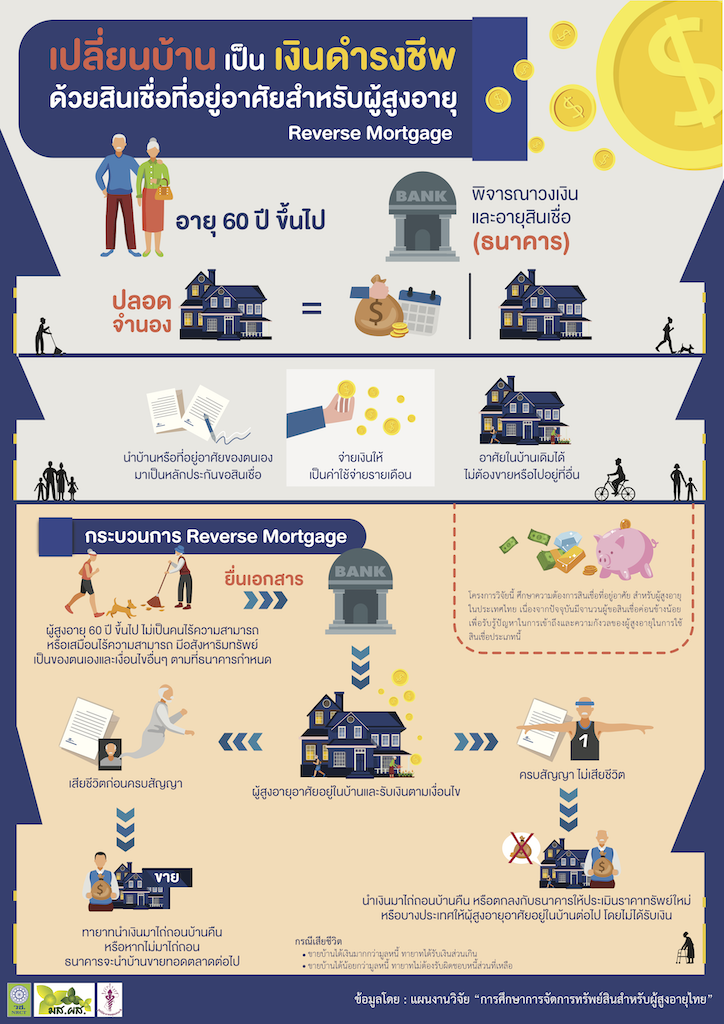

Accessibility_of_Reverse_Mortgage_for_Thai_Elderly_infographic.pdf

The objectives of this study are, first, to evaluate the demand for reverse mortgage and, second, to understand problems and obstacles related to Thai elders’ access to and concerns on reverse mortgage. The study employs both quantitative and qualitative analyses. The quantitative part utilizes a questionnaire-based survey from 148 Thai elders aged between 55 and 70 years, while the qualitative analysis relies on in-depth interviews of the current reverse mortgage borrowers whose contracts were initiated during July 2019 to February 2020.

Our results show that 65.07% of the sample do not know or have never heard of reverse mortgage. However, after explained the details of the reverse-mortgage product currently offered by Government Saving Bank and having discussion with their family members, 51.02% of the elders in our sample express their interest in the product. More interestingly, we find that the main reason for the elders’ interest in reverse mortgage is the need of future living expenses, whereas the bequest motive is the main argument for those not interested in it. However, the study shows that reverse mortgage is not the mostly preferred choice to meet these elders’ future funding needs. Instead, the more popular choices are requesting for support from their immediate family members and selling their fixed assets. Based on the logistic regression, we find that having single status and attitude toward indebtedness are the key determinants of demand for reverse mortgage. In addition, the in-depth interview results reveal that the reverse-mortgage users are those having high education, being widows, or living alone or with their spouse.

All in all, our study provides an important policy implication on making reverse mortgage more attractive for Thai elders. First of all, the government authority or banks may consider providing the alternative payment schemes to be more suitable to the elders’ demand, either in terms of timing or amount. Second of all, price is important. A decrease in the effective loan rate or an increase in the ratio of loan amount to collateral value could boost up demand for this product. Finally, the government may consider offering a reverse mortgage insurance service as a form of social security for Thai people.